The economic value of VFX in the UK is measured periodically in the BFI’s Screen Business report. This was published in 2021 and covered data from 2017, 2018 and 2019. The previous version of Screen Business was published in 2018 and featured 2016’s data. The latest report also updates 2016’s data. The data presented on this page is drawn from the 2021 report.

UK Screen Alliance is part of the steering group for the Screen Business report.

The primary purpose of the report is provide the evidence of the return on investment generated by the Screen sector tax reliefs necessary to ensure continued government support for these incentives. The data in the latest report provides a benchmark for the level of pre-pandemic activity in the industry. The report shows that every £1 of film tax relief generated £8.30 of value for the UK economy and each £1 of high-end TV relief returned £6.44 of value.

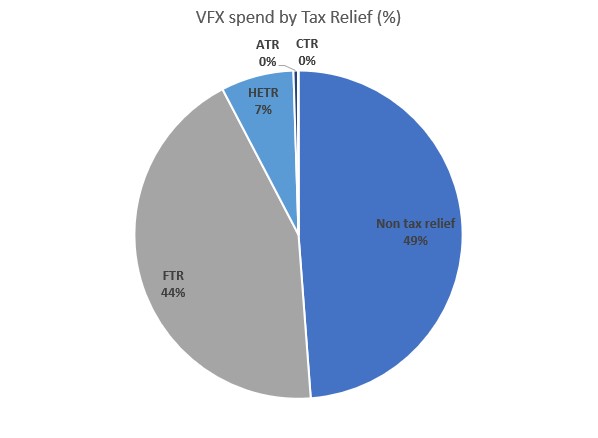

Even though VFX does not have a specific tax credit in the UK to incentivise inward investment, it can be an eligible expense within claims for the Film Tax Relief (FTR) or High End TV Tax Relief (HETR), Animation Tax Relief (ATR) or Children’s TV Tax Relief (CTR).

The BFi’s remit does not extend to commercials and other non-film/TV work but Screen Business does estimate the whole size of the VFX market whether or not its was work supported by the Screen Sector tax reliefs.

From a combined UK VFX spend during 2019 of £710m for tax relief related activity and non-tax relief related work, such as advertising, the report estimates that the sector contributed £1.68bn in GVA to the UK economy and supported 27,430 jobs. This is known to be an under estimate as the analysis of spill-over impacts attributable to advertising and brand promotion work, which creates considerable value through increased sales of the advertised goods and services, was outside the scope of the report.

The overall UK VFX workforce was estimated at 10,680 FTE (full time equivalents), of which 5,470 were employed on tax relief related work. These jobs generate high productivity, delivering £89,743 of GVA per FTE, which is £23,643 more per person than the average for the whole UK economy.

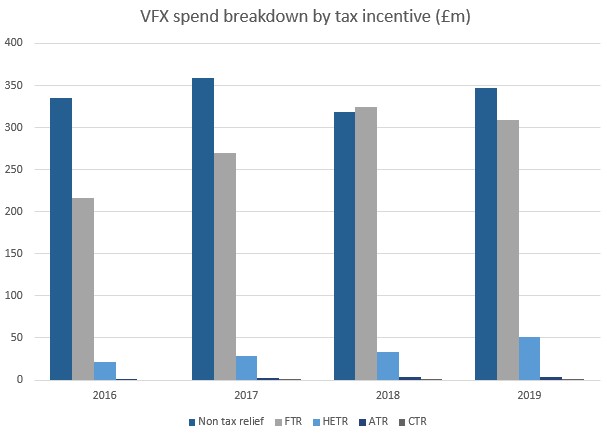

In 2019, an estimated £363.5 million was spent on VFX services in the UK for projects claiming FTR, HETR, ATR and CTR. This was up from £239.8m in 2016; a growth of 51.6%.

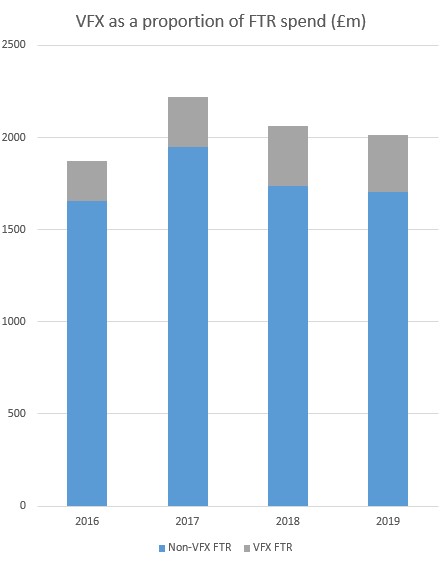

Overall production spending via the FTR rose by 7.6% between 2016 and 2019 but the VFX portion of FTR spending rose by 42% over the same period, to reach £309m in 2019, which is 15.3% of the total FTR supported spending.

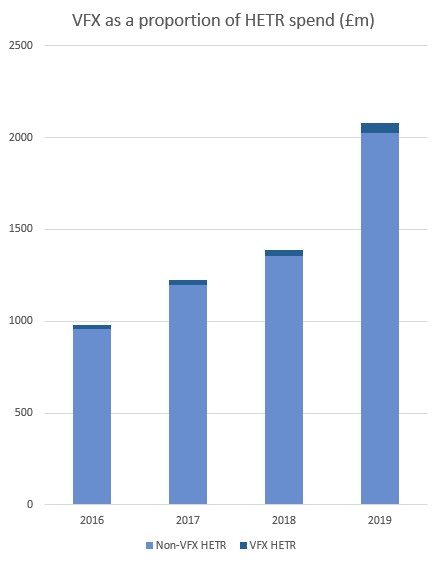

There has been strong global growth in HETV production driven by the streaming video providers and overall the UK has seen HETV production spend grow by 113% from £977.2m in 2016 to £2078.3m in 2019. The VFX spend in the UK claiming HETR, mirrors this increase and has risen by 131% since 2016 and stood at £50.9m in 2019. However this represents just 2.5% of the total HETR claimed in that year.