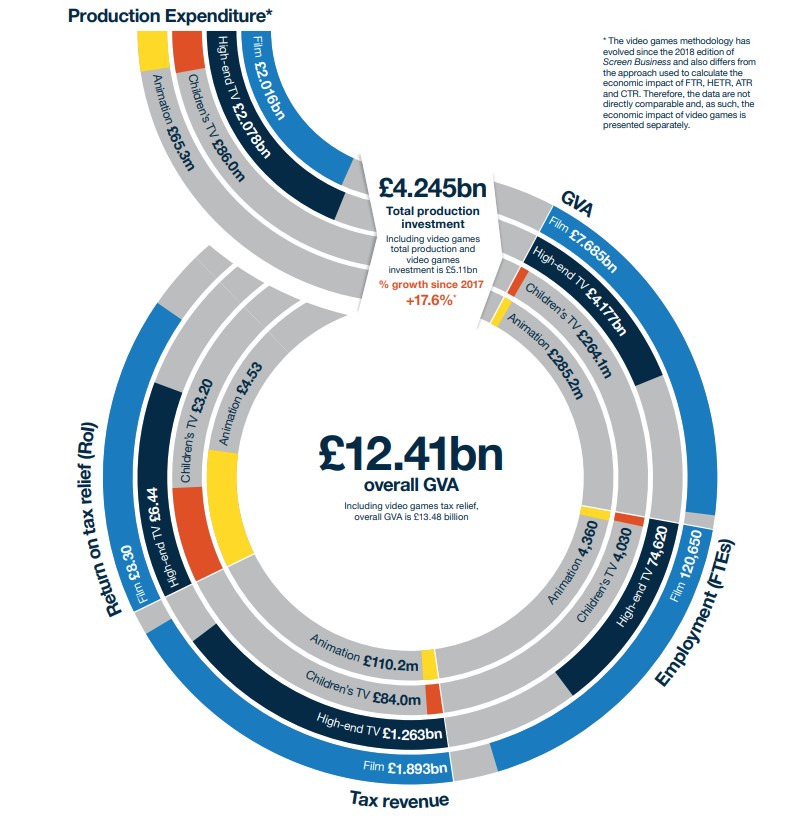

TODAY (13th Dec 2021) , the BFI has released vital new research in it’s Screen Business Report demonstrating the positive impact of tax relief on output across the screen industries. The Animation Tax Relief was introduced thanks to the successful campaign led by Animation UK in 2013. Since then, production spend figures related to tax relief have significantly impacted every part of the sector.

Although this research shows a downturn in production expenditure in relation to the specific Animation Tax Relief in the period up to 2019, the bigger picture is revealing. Whilst production spend on animation for TV and online dipped, there has been a significant increase in Animated films from £80m in 2016 to £520.4m in 2019. Combining the figures for Animation film, TV and online, we see an increase in animated content overall. The ecology of the industry (business model and workforce) is interdependent. Work on features films, inward investment in animation services and sequences provided for international commissioners is increasingly lucrative.

Production spend represents just part of the broader value of the Animation sector, reflecting the importance of tax reliefs to support new brands and the creation of downstream revenue. Further research will capture the value of broader sectors (advertising, corporate and education) plus the ancillary licensed products that it generates, such as children’s DVDs, books, theme parks, toys and clothing and the licensed merchandise sales market for the UK animation sector.

Read further here: BFI Screen Business Report

“As a sector that proved Covid resilient and with the combination of a growing international market, we are currently seeing a bounce in production levels, says K, “but these figures show we can’t be complacent. But it is a highly competitive market. The sector is facing many unique challenges. We need to ensure we are offering competitive tax incentives that create the right conditions for growth and incentivise retention of IP. The global market is huge and growing, and we are determined to increase our market share. Reviewing tax reliefs will be an important part of our plans, and this report provides the basis for these conversations with partners and the Government.”

Kate O’Connor, executive chair at Animation UK

“The UK has a long history of producing world-beating Animation IP, when we can own and exploit that IP, not only are we educating and entertaining children right around the world we can also bring in a lot of money to the in the form of new jobs and new business. Our key competitors are offering government-backed incentives to attract animation work. Despite our reputation, there is not a level playing field. UK producers and studios are already challenged in putting together funding packages due to reduced UK commissioning budgets and in the UK. They are increasingly having to resort to co-production with a business operating outside the country, losing a significant proportion of IP rights in the process.”

Oli Hyatt, Managing Director and Co-founder BlueZoo

“At a time of unprecedented demand for content, it is a genuine concern if the ATR production spend continues to decrease. That said, we have one of the best global production centres for animated content, Jellyfish Pictures has invested extensively in growing our studios across the UK, we are the most geographically diverse of the screen sectors, and it would be a huge loss to lose that production spend to other countries. To compete globally, we have to keep up with the tax credits offered elsewhere.”

Phil Dobree, CEO Jellyfish Pictures

READ UK Screen Alliance response to Screen Business Report 2021 here

Notes:

The UK has a long tradition in creating successful animation programmes such as The Gruffalo, Peppa Pig and the Wallace and Gromit franchise, which have become global franchises generating millions in revenues and long-term intellectual property (IP) value for UK creators. Animation is also easily adapted to other languages, a benefit for exports and revenues that can be generated for many years into the future. Such projects can also generate significant downstream value, particularly through merchandise sales and tourism.

Tax relief for animation programmes was introduced in 2013 to support a sector facing strong overseas competition and falling license fees from broadcasters. However, the full value of the animation sector is not solely presented within the impacts of the Animation Tax Relief alone; animation production is also contributing to the film, children’s television, and video games industries. For example, between 2016 and 2019, 14 animation feature films were made with a combined production spend of £374.1 million; further spend is captured within the HETV spend.

The tax relief enabled £65.3m of production expenditure in 2019, decreasing £114.7 million in 2016. This spend on production included £38.3 million in inward investment and co-production.

Animation programmes are estimated to have generated £130.6 million in direct GVA, £74.2 million in direct tax revenue and 1,460 FTEs of direct employment in 2019. Tax relief supported animation with the additional value chain and spillover impacts generated an estimated GVA of £285.2 million and tax revenue of £110.2 million, delivering 4,360 FTEs of employment.

Tourism and other impacts

Animation generates significant economic benefits to the tourism sector, eg. CBeebies Land at Alton Towers in Staffordshire showcases some of the most popular CBeebies programmes, including Hey Duggee, In the Night Garden and Teletubbies. Peppa Pig World at Paultons Park in Hampshire consistently receives over 1 million visitors a year. In addition, Wallace & Gromit’s Musical Marvels toured the UK in 2019.

The total economic contribution of the animation programmes tax relief

Animation delivers a strong return on investment for the tax relief; it is estimated that 50% of animation programmes supported by the tax relief would not have occurred without the animation tax relief.

–

About Animation UK

Animation UK provides the collective voice of the Animation sector, representing production companies, studios, distributors, and service providers.

Animation UK has highlighted the cross-sector strengths of the Animation sector and worked on behalf of the children’s animation industry to campaign for the introduction of Animation Tax Credit, which successfully came into force in early 2013. Animation UK will continue to press for other economic and business policy changes and incentives to ensure the sector remains competitive, including ensuring our tax relief keeps pace with competitors. Our call for a Shorts Fund Programme has led to a new BFI Shorts Funding programme, now in the second round. We actively supported the introduction of the Young Audience Content Fund and now strongly support its continuation. Animation UK also supports exporting activity and works with all partners to develop skills and talent pipeline.

Note on Further Research

The Animation sector produces content for television, feature films, plus series work for Amazon. Netflix and long-form TV series, commercials, websites, games and virtual reality. Therefore, the tax relief production expenditure is just part of the value of the overall sector and a new Animation Mapping by the BFI will be published in 2022.