Section: Industry

The economic value of the UK’s VFX sector

The economic value of VFX in the UK is measured periodically in the BFI’s Screen Business report. This was published in 2021 and covered data from 2017, 2018 and 2019. The previous version of Screen Business was published in 2018 and featured 2016’s data. The latest report also updates 2016’s data. The data presented on this page is drawn from the 2021 report.

UK Screen Alliance is part of the steering group for the Screen Business report.

The primary purpose of the report is provide the evidence of the return on investment generated by the Screen sector tax reliefs necessary to ensure continued government support for these incentives. The data in the latest report provides a benchmark for the level of pre-pandemic activity in the industry. The report shows that every £1 of film tax relief generated £8.30 of value for the UK economy and each £1 of high-end TV relief returned £6.44 of value.

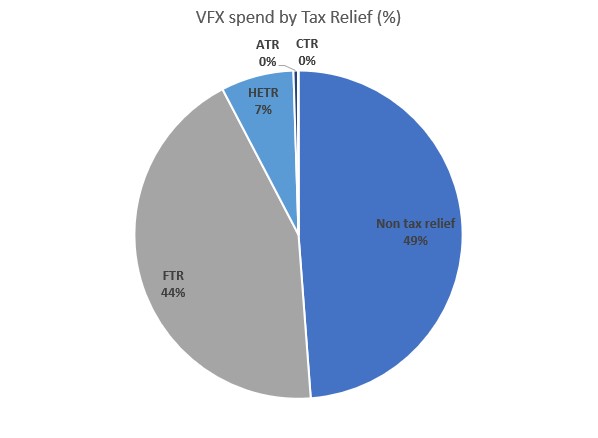

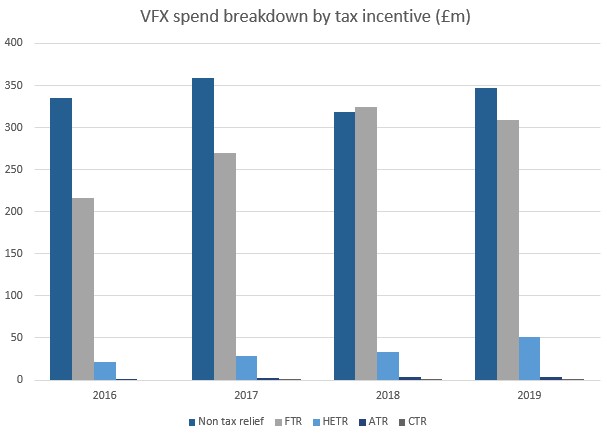

Even though VFX does not have a specific tax credit in the UK to incentivise inward investment, it can be an eligible expense within claims for the Film Tax Relief (FTR) or High End TV Tax Relief (HETR), Animation Tax Relief (ATR) or Children’s TV Tax Relief (CTR).

The BFi’s remit does not extend to commercials and other non-film/TV work but Screen Business does estimate the whole size of the VFX market whether or not its was work supported by the Screen Sector tax reliefs.

From a combined UK VFX spend during 2019 of £710m for tax relief related activity and non-tax relief related work, such as advertising, the report estimates that the sector contributed £1.68bn in GVA to the UK economy and supported 27,430 jobs. This is known to be an under estimate as the analysis of spill-over impacts attributable to advertising and brand promotion work, which creates considerable value through increased sales of the advertised goods and services, was outside the scope of the report.

The overall UK VFX workforce was estimated at 10,680 FTE (full time equivalents), of which 5,470 were employed on tax relief related work. These jobs generate high productivity, delivering £89,743 of GVA per FTE, which is £23,643 more per person than the average for the whole UK economy.

In 2019, an estimated £363.5 million was spent on VFX services in the UK for projects claiming FTR, HETR, ATR and CTR. This was up from £239.8m in 2016; a growth of 51.6%.

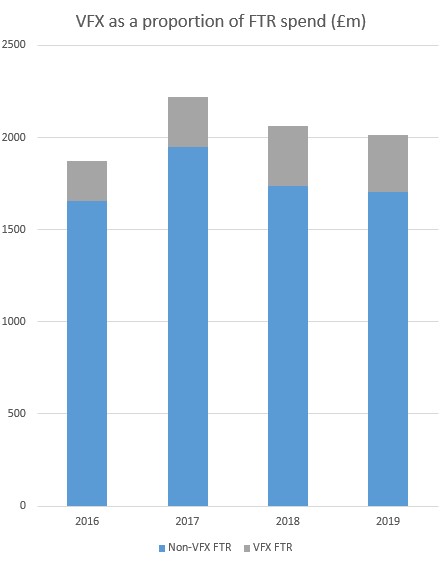

Overall production spending via the FTR rose by 7.6% between 2016 and 2019 but the VFX portion of FTR spending rose by 42% over the same period, to reach £309m in 2019, which is 15.3% of the total FTR supported spending.

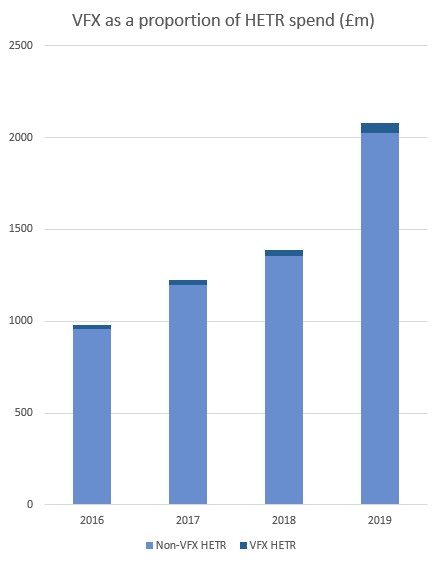

There has been strong global growth in HETV production driven by the streaming video providers and overall the UK has seen HETV production spend grow by 113% from £977.2m in 2016 to £2078.3m in 2019. The VFX spend in the UK claiming HETR, mirrors this increase and has risen by 131% since 2016 and stood at £50.9m in 2019. However this represents just 2.5% of the total HETR claimed in that year.

The UK’s VFX Workforce

UK Screen Alliance collects comprehensive data about the VFX workforce in the UK each year with the cooperation of the HR departments of the leading companies. We can therefore achieve a large sample size which gives a highly credible analysis of the composition of the workforce.

The BFI in its Screen Business report also makes an estimate of the number of people employed directly by VFX and the number of jobs supported by VFX in the wider economy. A bespoke job creation model was developed by Olsberg SPI from data from UK Screen Alliance workforce survey.

The following most recent statistics are drawn from these sources.

Number of people employed in VFX:

Direct employment: 10,680 [1] – FTE (Full Time Equivalents)

Total jobs supported by VFX in the complete film & TV value chain including indirect employment in the supply chain, induced jobs by spending of wages and spillover employment from tourism, merchandise and brand value: 27,430 FTE[1]

Payroll

Total direct employment costs VFX: £517.6m [1]

52% of VFX employees are basic rate taxpayers [2]

46% of VFX employees are higher rate taxpayers [2] (salary >£44.5k- 2017 tax band)

1% of VFX employees pay additional rate tax [2] (salary >£150k)

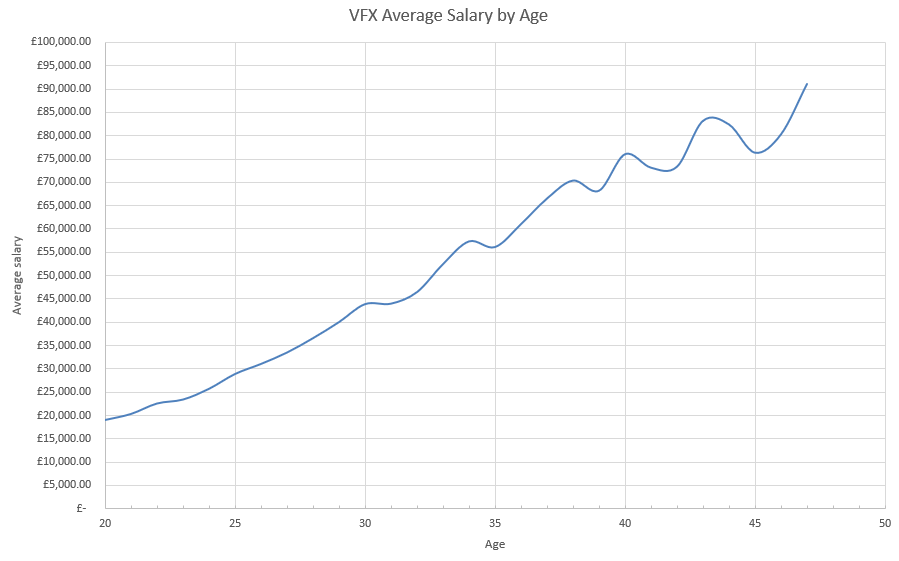

Median age of VFX artists is 31[2]

Median salary of VFX artists is £47,000[2]

Note on the chart above that on average VFX artists hit the £25,000 threshold to be required to pay back UK student loans by age 24 i.e. 3 years after graduation.

Also note that VFX artists earn do not an average of £30,000 until aged 26. This is the proposed minimum salary threshold for UK Skilled Worker Visas and therefore will constrain the recruitment of emerging talent from Europe if the UK government implements this proposal.

However the average pay in VFX at all ages exceeds the overall UK average as well as exceeding the average pay for the creative industries by a good margin.

Contract Type

The UK Screen Workforce Survey shows that in contrast to many parts of the film & TV industry, permanent employment is a lot more common with day or week rate freelance contracts being relatively rare. There are also significant differences between VFX for film & TV and VFX for advertising.

| Contract Type | VFX (Film/TV) | VFX (Advertising) |

|---|---|---|

| Permanent | 43% | 85% |

| Fixed term < 6 months | 22% | 6% |

| Fixed term between 6 months and 1year | 16% | 4% |

| Fixed term > 1 year | 16% | 5% |

| Freelance | 2% | – |

| Other | 1% | 1% |

Nationality

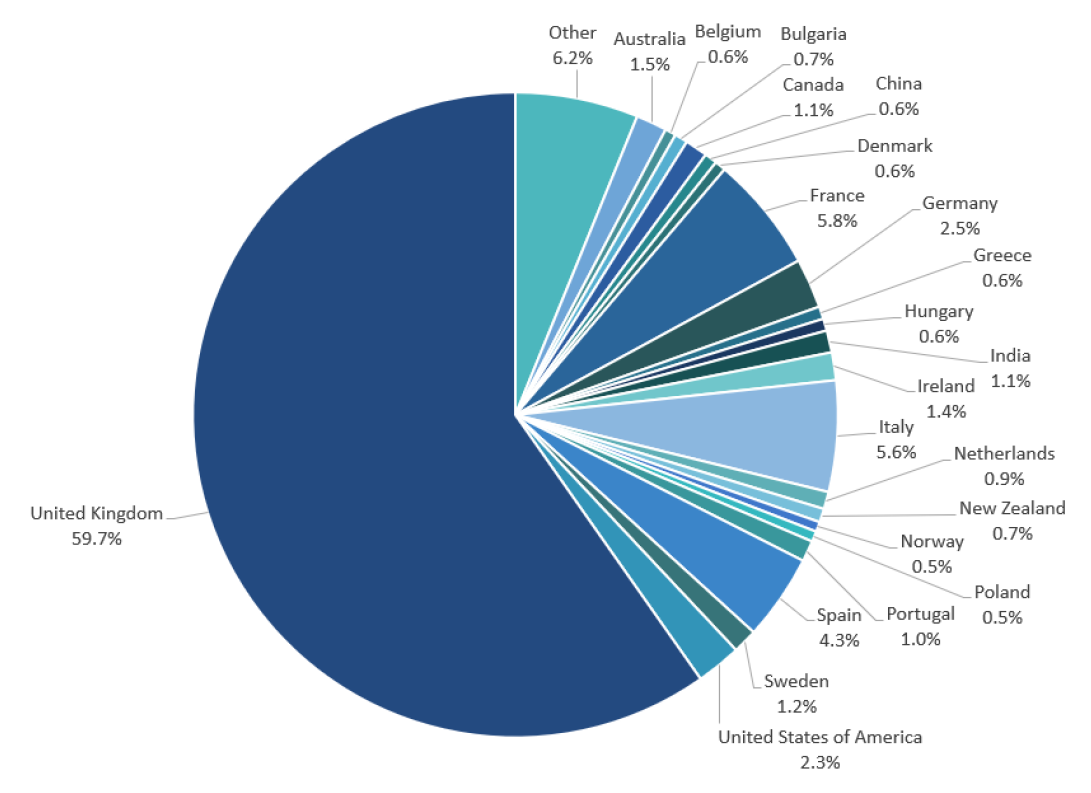

The VFX industry is highly cosmopolitan with more than 70 nationalities represented.

Source: UK Screen Alliance workforce survey 2017

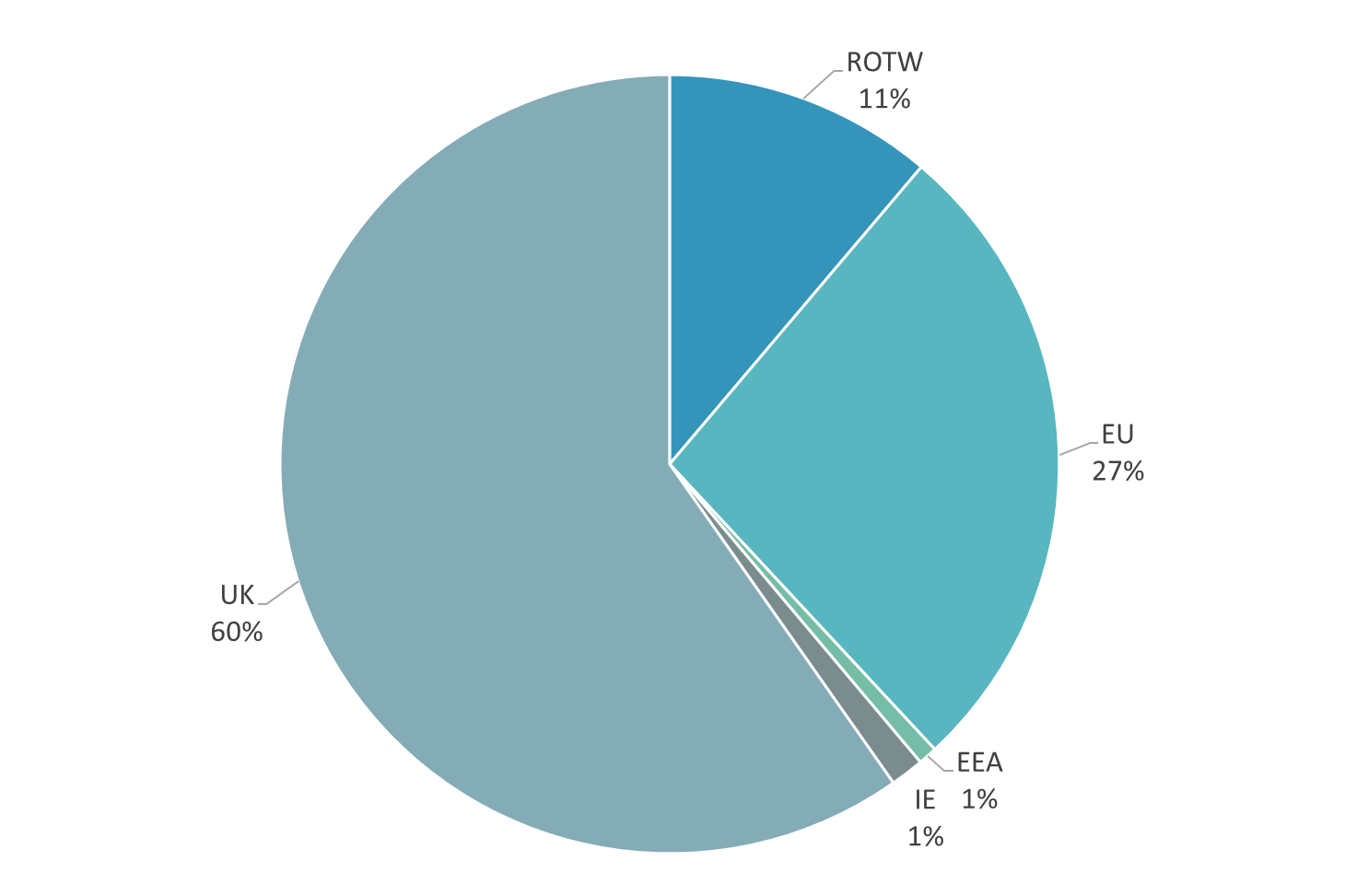

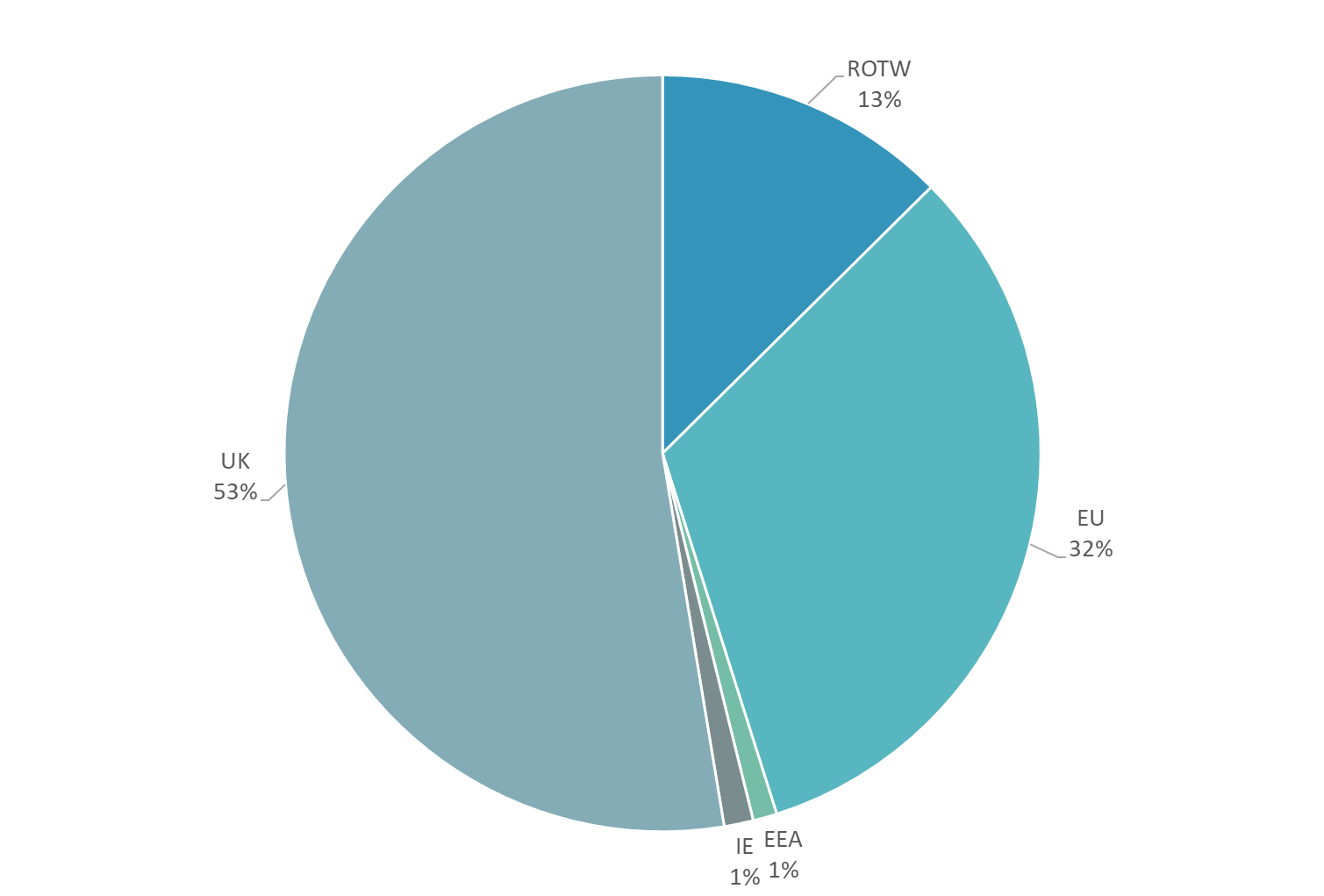

Whilst UK workers make up 60% of the total VFX workforce, the concentration of international workers is greater in the operational workforce (i.e artists, production, R&D and technical support but excluding admin, HR, finance an client services). Without the operational workforce there would be no business.

European workers make up one in three of the operational workforce, so the ending of the free movement of labour as the UK exits the EU, will have an adverse effect as visas are introduced for EU skilled workers. Note that there is also 13% of the workforce from non-EU countries (ROTW = Rest of the World)

Diversity

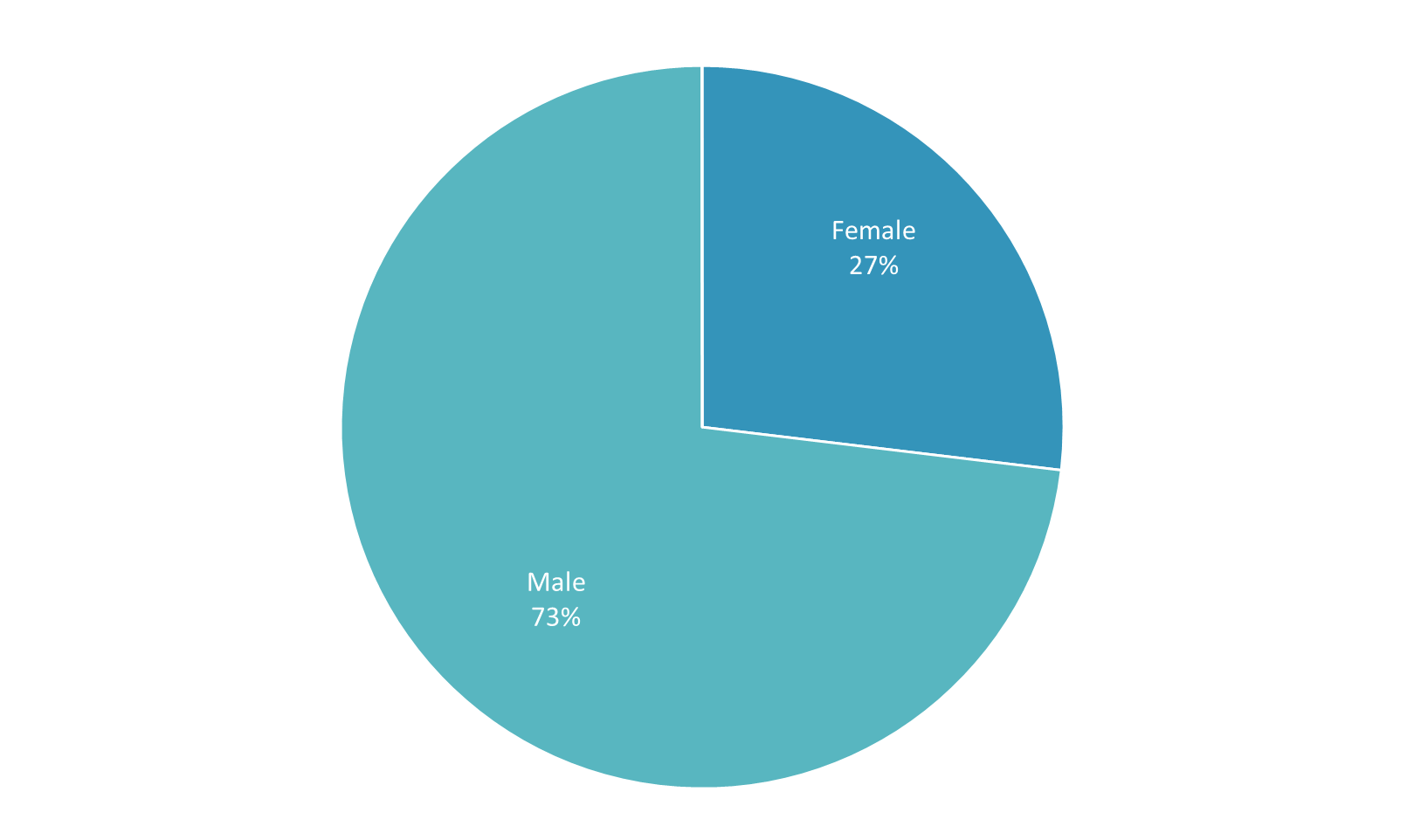

Gender

Only 27% of the workforce in VFX are female. There remains much to do in breaking down gender stereotyping to encourage women to study for and apply for the many roles that require technical or coding skills.

There is however an improving picture and evidence in the UK Screen Alliance workforce survey suggest that the gender balance is more even in the younger age group of VFX workers. Therefore if this pattern of recruitment and retention is maintained, over time this will have a beneficial effect on the ratio in the whole workforce as more women progress to senior roles. There is also a need to ensure that women return to the VFX industry if they take time out for the birth of their children, so that their valuable experience is not lost.

These factors will also be fundamental to improving the gender pay gap in the sector, which is between 24% and 33% [7]. There is little evidence of widespread disparity in pay between people of different genders performing the same role with similar levels of experience, however the historical pattern over 20 years of senior managers and artists tending to be male, drives the calculated pay gap upwards which is based on the median salary levels across an entire company. The proportion of women in the top quartile of earners in VFX companies ranges from 11.1% to 16.5% [7].

The gender balance is not the same in all departments. The IT and R&D departments are the most male dominated but the production departments are 60% women[2].

For information and figures on representation of gender in this sector, see out page on Inclusion and Diversity in the UK animation VFX and post production.

Ethnicity

Many VFX companies do not routinely collate statistics on the racial origins of their workforce. UK Screen Alliance is encouraging them to do so in future so that progress in this important area can be monitored. It may be become mandatory in future if ethnicity pay gap reporting becomes mandatory.

For information and figures on representation of ethnicity, see our page on Inclusion and Diversity in the UK animation VFX and post production sectors.

Disability

For information and figures on representation of disability and neurodiversity, see our page on Inclusion and Diversity in the UK animation VFX and post production sectors.

References:

[1] BFI Screen Business report 2021

[2] UK Screen Alliance workforce survey 2017

[3] UK Screen Alliance workforce survey 2017

[5] Gov.UK ONS statistics – Population of UK

[6] Gov.UK ONS Statistics -Regional ethnic diversity

[7] Gov.uk Gender pay Gap 2018 reported median figures

APPLYING UK TAX INCENTIVES TO POST & VFX

VFX and post production are allowable costs within the Audio Visual Expenditure Credit (AVEC), providing the qualifying criteria are met. A minimum UK expenditure requirement of 10% of total budget must be exceeded, and the project must qualify as British via the Cultural Test or be an official co-production. Note that there are sufficient points available in the Cultural Test to qualify if only performing VFX or post in the UK.

You do not need to perform all production activity in the UK and it is absolutely possible to claim UK tax relief for post and VFX only, even if no principal photography occurs in the UK.

It is essential to set up a UK based limited production company (FPC or TPC) before shooting begins in order to account for all production costs, even if only the post-production or VFX occurs in the UK.

The VFX uplift

Since January 1st 2025, VFX expenditure will receive an uplift to the AVEC from 25.5% to 29.25% net after tax, and will be exempt from the overall 80% cap on total core production spend eligible for UK tax relief. This will mean that productions could receive 25.5% relief on filming and other non-VFX costs in the UK (up to 80% of total core spend) and still receive a 29.25% rebate on their VFX spend regardless of whether that spend takes their total UK core spend above the 80% cap on eligibility for relief. Any VFX activity claimed must occur in the UK and the basic AVEC qualification criteria must be met.

Relevant visual effects work is defined as the use of computer technology to create or alter images for inclusion in a film or programme. The cost of third-party vendor contracts to provide any of these common services, or other work to digitally alter or create images, is allowable:

- Pre-visualisation (provided it does not occur in the development phase)

- Concept design (provided it does not occur in the development phase)

- Storyboarding to plan VFX work/shots

- Creating CGI backdrops, characters and wholly CGI shots to be added to filmed footage

- Compositing

- Colour correction

- Beauty work

- Character and creature animation

- 3D modelling

- LIDAR scanning and photogrammetry (where it is used to create VFX environments and assets)

- Lighting and rendering

- Digital matte painting

- Temporary shots used for editing

- Motion capture (including body scans & facial capture)

- Stereo 3D conversion

- Producing images for virtual sets

The definition does not extend to the principal photography that creates the images that VFX artists work on.

VFX costs relating to Virtual Production will be eligible for the uplift, but not costs of shooting in front of LED walls (you can still claim standard AVEC for virtual production on-set costs at 25.5% net, if below the 80% cap)

SFX costs are not included in the uplift (you can still claim standard AVEC at 25.5% net, if below the 80% cap)

If VFX is part of a full-service post-package including non-VFX services, the production company must apportion the fee paid to the vendor on a just and reasonable basis, to exclude the element that relates to non-VFX services.

VFX within the Enhanced AVEC for Limited Budget Films

In 2024, a new tax credit for films with budgets under £23.5 million was introduced; colloquially known as the Indie Film Tax Credit (IFTC), even though it is not restricted to independent films and low budget studio films could also qualify. Relief is tapered if the budget of these films exceeds £15 million and the maximum net rebate that can be claimed is £4.77 million.

The VFX uplift cannot be combined with the IFTC or with the animation tax credit. However any VFX or post production expenditure on films claiming IFTC, are eligible costs, and could receive a net rebate of up to 39.75% depending whether the 80% cap on total eligible UK expenditure, or the overall £4.77 million IFTC cap are exceeded. If the budget is betwen £18 million and £23.5 million, it may be worth transfering to the AVEC, if there is significant VFX expenditure, as the uplift can then be claimed on this spend which will be exempt from the 80% cap and therefore the overall UK net rebate may be higher.

UK Film and TV Tax Incentives

In 2024, the four UK screen sector tax credits for film, high-end TV, children’s TV and animation, were modernised and combined into a single tax system, the Audio Visual Expenditure Credit or AVEC. There are however separate rules for the four sectors served by the AVEC.

There is no cap on the total funds available and the scheme does not have a “sunset” date. The expenditure must be for goods or services used or consumed in the UK.

The new AVEC, unlike the previous reliefs, is taxable at the main rate of Corporation Tax (25%). The headline gross rates of rebate have been increased to give equivalent or better value.

For qualifying Films or High End TV projects, the Film Production Company (FPC) or TV Production Company (TPC) can claim a cash rebate of 34% gross on eligable UK core expenditure. This equates to 25.5% net after tax.

Foe Children’s TV and Animation, the rate of rebate has been increased to 39% gross on UK qualifying expenditure, which equates to 29.25% after tax. Previously the animation relief was just for TV productions and feature animations claimed via the film tax relief. Now both film and TV animation can claim at 29.25% net after tax.

In April 2024, the government announced the introduction of additional relief for limited budget films. The rate of relief on films with budgets less than £15 million has been increased to 53% which equates to 39.75% net after tax.

The Tax Relief is capped at 80% of the core expenditure i.e. even if you have 100% UK-qualifying expenditure, tax relief is only payable on up to 80%. However in the 2024 Autumn Budget, it was confirmed that from January 1st 2025, the 80% cap restriction on spend eligible for the UK film and HETV tax credits would be removed for the VFX spend only, and that the rate of rebate for VFX would increased to 29.25% net after tax.

There is no upper limit on the budget of the film/TV project or amount of relief payable within the 80% cap.

To qualify for Film or High End TV , projects must:

- Have a minimum 10% of core expenditure spent in the UK

- Have one FPC or TPC registered as a UK Limited Company with Companies House and set up before shooting begins

- The FPC/TPC must be responsible for all activity from pre-production through to completion

- Must qualify as British via the Cultural Test or be an official co-production

To access the Film Relief, there must be an intention for theatrical release

To access the HETV Relief for scripted televsion projects, the minimum core expenditure must be at least £1million per broadcast hour (shorter episodes can qualify if commisioned together as a series and the total spend per broadcast hour exceeds £1million)

To access the animation relief, at least 51% of the production cost must relate to animation.

A little known feature of the UK tax reliefs is the ability to claim for pro-rated neutral costs in addition to the direct UK spend. Qualifying neutral costs which are spread throughout the production such as senior producers, writers, directors and insurances may be claimed in proportion to the actual activity in the UK (e.g. if direct UK qualifying costs make up say 22% of the budget, then 22% of the neutral costs will also qualify for UK Tax relief. By claiming pro-rated neutral costs in addition to the direct UK spend, the perceived tax relief rate on direct UK spend is raised above 25% and may even reach 30% depending on the production’s above-the-line costs. Note that the pro-rated neutral costs may also be used to lift the production above the minimum 10% threshold required to qualify for the relief.

It is also possible to claim contingient compensation costs for above the line talent for their work in the UK. When thees costs are incurred they can be the subject of futher claims for rebate.

How a project can qualify as British

A project can qualify as British by passing the cultural test, or as an official co-production.

The UK has film co-production agreements with Australia, Canada, China, France, India, Israel, Jamaica, Morocco, New Zealand, Occupied Palestinian Territories, and South Africa. Of these, Australia, Canada, New Zealand, Israel and the Occupied Palestinian Territories also allow for television programmes.

The UK is also a signatory to the European Convention on Cinematographic Co-production.

The cultural test is a points-based test where the project needs 18 of a possible 35 points to pass. It comprises four sections:

Section A – Cultural content | ||

|---|---|---|

| A1 | Set in the UK or EEA | 4 Points |

| A2 | Lead characters British or EEA citizens or residents | 4 Points |

| A3 | Film based on British or EEA subject matter or underlying material | 4 points |

| A4 | Original dialogue recorded mainly in English language or UK indiginious language or EEA language | 6 Points |

Section B – Cultural contribution | ||

| B | Film demonstrates British creativity, British heritage and/or diversity | 4 Points |

Section C – Cultural hubs | ||

| C1(a) | At least 50% of the principal photography or SFX takes place in the UK | 2 points |

| C1(b) | At least 50% of the VFX takes place in the UK | 2 points |

| C1(c) | An extra 2 points can be awarded if at least 80% of the principal photography or VFX or SFX takes place in the UK | 2 points |

| C2 | Music recording/audio post-production/picture-post production | 1 point |

Section D – Cultural practitioners (UK or EEA citizens or residents) | ||

| D1 | Director | 1 point |

| D2 | Scriptwriter | 1 point |

| D3 | Producer | 1 point |

| D4 | Composer | 1 point |

| D5 | Lead actors | 1 point |

| D6 | Majority of the cast | 1 point |

| D7 | Key staff (lead cinematographer, lead production designer, lead costume esigner, lead editor, lead sound designer, lead visual effects supervisor, lead hair and makeup supervisor | 1 point |

| D8 | Majority of the crew | 1 point |

| Total | 35 points | |

The cultural test is adminstered by the BFI’s Certification Unit who manage the application process as well as giving useful advise to productions on how to pass the test.

Applicants can apply for interim certification at any point before or during production. Interim certification is essential if you wish to claim tax relief during production. A final application must be submitted once the project is complete.

Futher information on AVEC can be obtained from the British Film Commission

The economic value of post-production in the UK

The post-production sector includes editing, grading, picture and audio finishing, deliverables and international versioning as well as visual effects (VFX). The VFX sector is so large with a prestigious profile that it is often thought of as a sector in its own right. Unfortunately, as a result, the remainder of post-production is often not properly recognised by many sector reports or is submerged when combined with VFX in official statistics.

The VFX sector has a major evaluation of their financial value included in the BFI’s Screen Business report , but the remainder of the post-production sector is not analysed separately. A portion of post business for film or high-end drama is included in the report albeit combined into the full value of film and HETV production.

The last comprehensive analysis of the whole post-production and facilities sector was conducted by Olsberg SPI for UK Screen in 2010; a time before the HETV tax credit and the growth of SVOD networks. The survey provided important data to underpin our campaigns for additions to the screen sector tax credits and proper recognition of our sector within government policy. We urgently need to update that data but it is unlikely that we will be able to finance such a comprehensive study at this time and will have cut our cloth from the available resources.

Televisual magazine produces an annual listing of the Top 50 facility companies ranked by criteria such as size and turnover together with client and peer polls. The economic analysis included in their survey should be viewed with a degree of caution as the results are shown as a league table causing some participants to overstate their capability and turnover to achieve a higher ranking. There are also several big players who do not participate and so while the Televisual survey undoubtably provides good insights into some of the top companies in the sector, it is an incomplete picture.

Official government data gathered by the Office of National Statistics (ONS) recognises post-production as a distinct industrial classification, but this covers the whole of post including VFX and there are no subdivisions. However, these are the National Statistics that the government accept and rely on, so it is important to make sure that they are as accurate as possible.

Businesses are classified by ONS by their Standard Industrial Classification (SIC) code. The SIC code for post-production is 59120. Companies self-classify by selecting the most appropriate code and notifying it in their annual Confirmation Statement to Companies House.

In 2016, UK Screen Alliance checked the records at Companies House to see how many post-production businesses were incorrectly classified and discovered over £322m of turnover that was not being recognised as post-production. We wrote to many of those businesses asking them to re-classify into SIC 59120 and many did, resulting in over £50m of turnover being moved to the correct classification which boosted the officially reported value of our sector in National Statistics. There is still over £250m of turnover incorrectly accounted for so we ask post-production business to check the appropriateness of their SIC code when notifying their next Confirmation Statement to Companies House.

2019 ONS statistics for the 59120 SIC code (Motion picture, video and television programme post-production activities)

- Number of Enterprises: 3,025 (includes all businesses from large enterprises to one person companies)

- Total Turnover: £1.258 billion

- Approximate GVA £860 million

- Number of employees 11,000 (this does not include freelancers, if not registered as limited companies)

Source: ONS Annual Business Survey 2019

Turnover distribution of post-production companies 2022

| Turnover size band | Number of Enterprises | % of Enterprises |

|---|---|---|

| <£50k | 705 | 22.2% |

| £50k-£99k | 835 | 26.3% |

| £100k-£249k | 1,130 | 35.6% |

| £250k-£499k | 235 | 7.4% |

| £500k-£999k | 110 | 3.5% |

| £1m -£1.999m | 65 | 2.1% |

| £2m – £4.999m | 45 | 1.4% |

| £5m – £9.999m | 20 | 0.6% |

| £10m – £49.999m | 20 | 0.6% |

| >£50m | 5 | 0.2% |

| Total | 3,170 | 100% |

Source: ONS Inter-Departmental Business Register (March 2022)

Distribution of post-production companies by employent size bands 2022

| Employent size band | Number of Enterprises | % of Enterprises |

|---|---|---|

| 0-4 | 2,935 | 92.6% |

| 5-9 | 105 | 3.3% |

| 10-19 | 60 | 1.9% |

| 20-49 | 30 | 0.9% |

| 50-99 | 25 | 0.8% |

| 100-249 | 10 | 0.3% |

| 250+ | 5 | 0.2% |

| Total | 3,170 | 100% |

Source: ONS Inter-Departmental Business Register (March 2022)

Regional distribution of post production enterprises 2022

| Region | Number of Enterprises | % of Enterprises |

|---|---|---|

| ENGLAND | 2975 | 93.8% |

| London | 1,570 | 49.5% |

| South East | 595 | 18.8% |

| South West | 210 | 6.6% |

| North West | 125 | 3.9% |

| North East | 20 | 0.6% |

| Yorkshire and Humber | 65 | 2.1% |

| West Midlands | 80 | 2.5% |

| East Midlands | 55 | 1.7% |

| East of England | 255 | 8% |

| WALES | 70 | 2.2% |

| SCOTLAND | 90 | 2.8% |

| NORTHERN IRELAND | 35 | 1.1% |

| TOTAL | 3,170 | 100% |

Source: ONS Inter-Departmental Business Register (March 2022)

Animation Tax Relief in the UK

There is no cap on the amount of tax relief which can be claimed.

All reliefs are capped by EU State Aid regulation at 80% of total production budget.

An Animation Production Company (APC) can claim a tax relief of up to 25% of qualifying expenditure for qualifying animation programmes.

The project must be an animated programme, although it may be mixed content. To qualify as an animation programme, at least 51% of the core expenditure on the completed programme must be on animation production expenditure.

To qualify for animation programme tax relief, projects must:

- Have a minimum 10% of core expenditure spent in the UK

- Be intended for broadcast (including internet broadcast)

- Have one APC registered as a UK Limited Company with Companies House and set up before animation shooting begins

- The APC must be responsible for all the animation programme making activity from pre-production through to completion

- Must qualify as British via the Cultural Test or be an official co-production

How an animation project can qualify as British

An animation programme can qualify as British by passing the cultural test, or as an official co-production.

The UK has 10 bi-lateral co-production treaties and is also a signatory to the European Convention. Some of the bi-lateral treaties allow television co-production.

The cultural test for animation programmes is a points-based test where the project needs 16 of a possible 31 points to pass. It comprises four sections:

Section A – Cultural content | ||

|---|---|---|

| A1 | Set in the UK or an EEA state or (Up to 3 points will be awarded for set in an undetermined location) | Up to 4 Points |

| A2 | Lead characters British or EEA citizens or residents (or characters from an undetermined location) | Up to 4 Points |

| A3 | Animation based on British subject matter or relates to an EEA state or underlying material | 4 points |

| A4 | Original dialogue recorded mainly in English language | Up to 4 Points |

Section B – Cultural contribution | ||

| B | Programme represents/reflects British creativity, British heritage or diversity | Up to 4 Points |

Section C – Cultural hubs | ||

| C1 | At least 50% of the animation shooting or visual design or layout &storyboarding or VFX takes place in the UK | 2 points |

| C2 | At least 50% of the music recording or audio post-production or picture-post production or voice recording takes place in the UK | 1 point |

Section D – Cultural practitioners | ||

| D1 | 1 of the 3 lead directors is an EEA citizen or resident | 1 point |

| D2 | 1 of the 3 lead scriptwriters is an EEA citizen or resident | 1 point |

| D3 | 1 of the 3 lead producers is an EEA citizen or resident | 1 point |

| D4 | 1 of the 3 lead composers is an EEA citizen or resident | 1 point |

| D5 | 1 of the 3 lead actors/voiceover artists is an EEA citizen or resident | 1 point |

| D6 | At least 50% of the cast are EEA or residents | 1 point |

| D7 | At least 1 of the 7 key HoDs is an EEA citizen or resident | 1 point |

| D8 | At least 50% of the crew are EEA citizens or residents | 1 point |

| Total | 31 points | |

The cultural test is adminstered by the BFI’s Certification Unit who manage the application process as well as giving useful advise to productions on how to pass the test.

Applicants can apply for interim certification at any point before or during production. Interim certification is essential if you wish to claim animation tax relief during production.

A final application must be submitted once the programme is complete and ready to be broadcast to the general public.

The Animation Workforce

The UK is renowned for the quality of its highly educated and trained workforce and its nurturing of top animation talent.

The UK animation industry employs a highly skilled workforce of c.1000 people. This rises to 15,390 jobs supported in the wider value chain once spill-over benefits are factored in.

Existing research does not include the wider deployment and employment of animation roles within other related sectors such as Games, VFX or wider creative sectors, however recent NESTA research based on an analysis of 412 million job adverts cites Animation as the number one digital skill required.

New research is being planned to capture the application of animation skills across related and wider sectors.

52% of the workforce are freelance, and approximately 25% are non-EU in the sector.

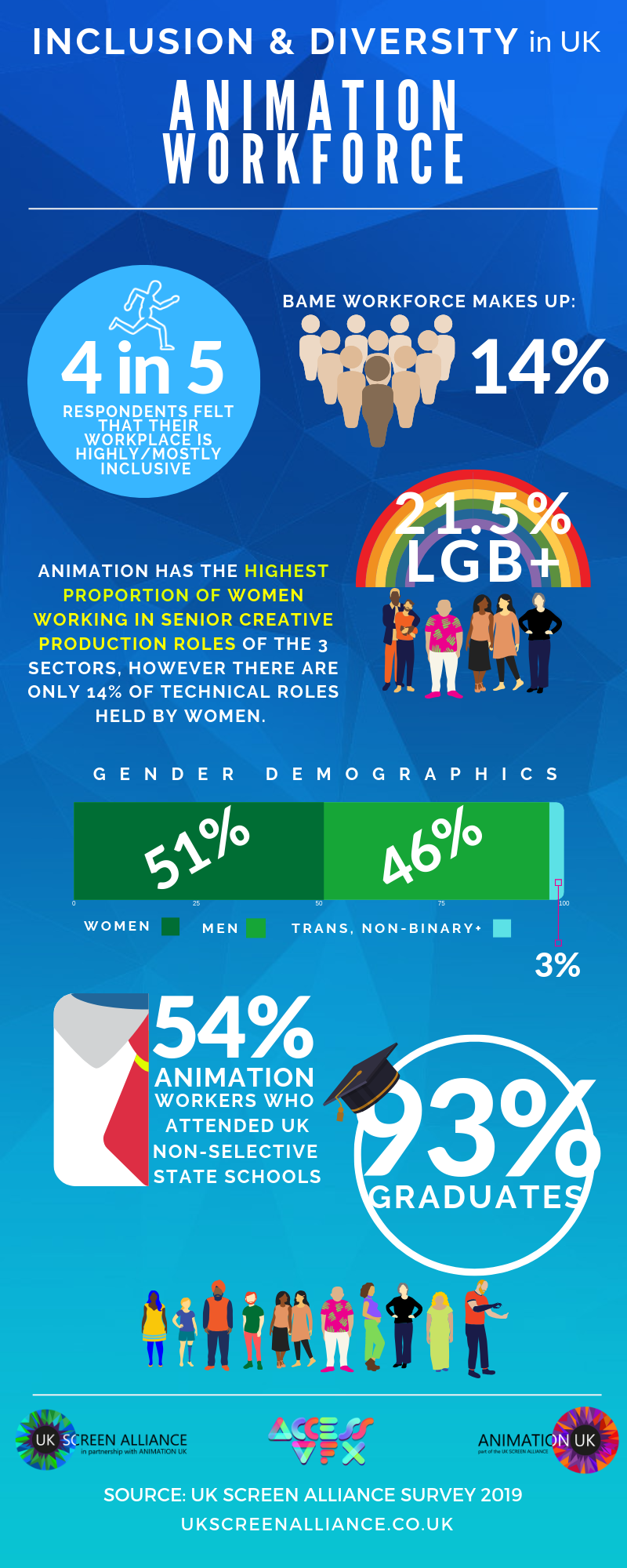

Inclusion & Diversity

In September 2019, the UK Screen Alliance in conjunction with Animation UK and Access VFX published a major report into inclusion and diversity in the UK’s VFX, animation and post-production sectors.

The report surveyed of more than 1,150 workers across the sectors, and revealed that in the UK animation industry, gender diversity achieves parity in animation with 51% of workers being women. In production management, women make up 89% of the workforce. Women are well represented in senior creative production roles (55%) and creative artist roles (49%). However only 14% of technical support roles are held by women.

21.5% of animation workers identified as LGB+, more than 10 times the ratio in the UK population. 3% specified their gender as either transgender, non-binary or some other preferred description.

The jobs in animation are more geographically dispersed than VFX or post-production with 27% of our respondents working outside London.

Highly qualified workforce

The animation workforce is highly qualified with 93% of workers having a degree and 26% also being post-graduates. For almost half of animation workers, neither of their parents obtained a degree.

9% of animation workers from the UK were educated at a private or fee-paying school. This is above the UK average of 7%. However, 54% of animation workers educated in the UK attended non-selective state secondary schools.

People working in the UK animation industry not only have a much higher level of qualification than the population at large, but also higher than the creative industries as a whole. 41% have an undergraduate degree, certificate or diploma, and a further 28% a postgraduate qualification.

The UK animation industry is well-supported by over 50 animation degree courses, accommodating nearly 2,400 students, as well as more than 230 higher education courses.

New Apprenticeships are being developed to complement the university degree pathways.

Top UK animation talent is celebrated at the biannual British Animation Awards, which covers all aspects of the UK animation scene, including student work, commercials, children’s entertainment, short and experimental art films, music videos and new technologies.

Animation UK has now been formed to provide a unified voice for the Animation Sector and will support the sector by developing a talent and skills plan to further develop the sector workforce.

The UK’s VFX Industry: In Profile

Visual Effects, or VFX for short, is the digital manipulation of images to enhance, augment or entirely replace elements of live-action shots in films, TV programmes or commercials. In some cases, entire shots, backgrounds and characters may be computer generated. VFX has become intrinsic in most feature films and many TV dramas

VFX is still a relatively young industry, which has gone through a period of significant growth in volume demand and which is characterised by a constant re-invention of the technology and workflows necessary to create increasingly complex effects. The Harry Potter franchise provided a springboard by which the UK’s VFX sector transformed itself from a cottage industry to what is widely acknowledged as a world-leading centre for visual effects production. London houses six of the world’s largest visual effects companies.

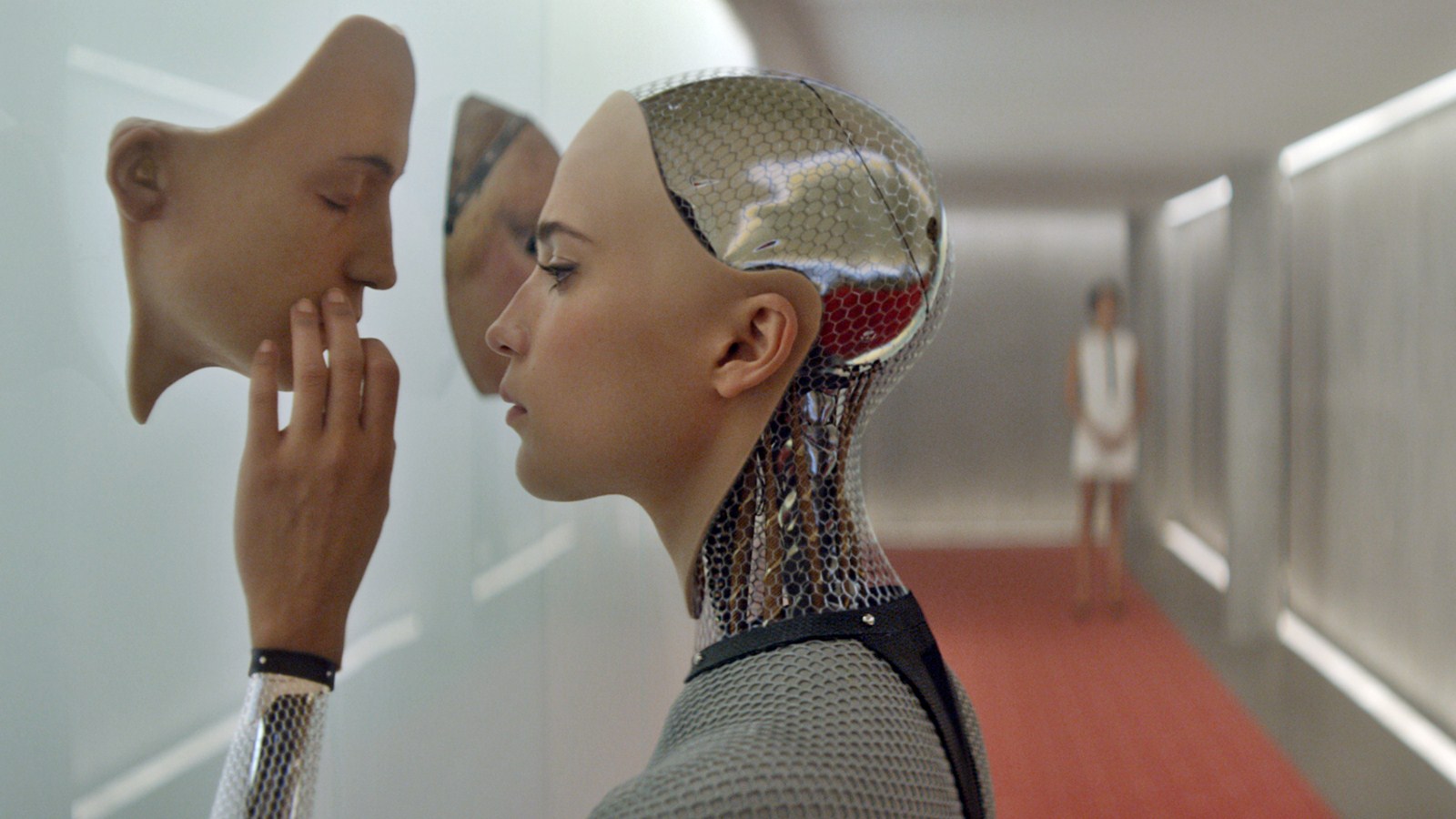

UK headquartered companies have won the VFX Oscar on numerous occasions, for Gravity, Interstellar, The Golden Compass, Inception, Ex Machina and The Jungle Book. In the VFX category of the Oscars in 2015, five out of six nominees and the eventual joint winners, Double Negative and Milk VFX, were British companies.

Oscar winning VFX from Double Negative and Milk Visual Effects

Whether it is visualising epic super-hero struggles in Guardians of the Galaxy; designing magical creatures for Fantastic Beasts; building vast alien landscapes for The Martian or re-creating convincing period drama environments for Florence Foster Jenkins, The Crown or Suffragette, the UK’s talented VFX workforce has a proven track record of delivering winning results, not just with the awards judges but also with global audiences. Framestore, Double Negative, MPC and Cinesite have long-standing reputations but the demand for VFX for High-End TV series has led to the growth of a new breed of highly agile boutique VFX houses such as Bluebolt, Union, One of Us and Milk.

In 2014, Industrial Light and Magic who performed the VFX for Star Wars, were encouraged by the UK’s film tax relief and other incentives to create 200 jobs in a new studio in London.

The UK VFX industry competes fiercely and successfully with rival production centres around the world – USA, Canada, Australia, New Zealand, India, South East Asia and the rest of Europe – to secure high volumes of inward investment work (predominantly from the USA) which helps to underpin domestic production as well as delivering significant economic and cultural benefit.

The UK Government supports the VFX sector, and the wider film and television industry, to build on its world-leading status through a combination of production tax incentives and R&D tax reliefs.

In 2014, the thresholds for the UK’s highly flexible Film and High-End TV (HETV) tax credits were lowered allowing inward investment productions to qualify solely based on VFX or other post-production performed in the Britain.

In the 2024 Autumn Budget, it was confirmed that from January 1st 2025, the 80% cap restriction on spend eligible for the UK film and HETV tax credits would be removed for the VFX spend only, and that the rate of rebate for VFX would be increased to 29.25% net after tax.

The Value of Animation to the UK Economy

The latest research shows that production expenditure, supported by the Animation Tax Relief, reached an estimated £97.1 million in 2016. [#]

This is an increase of 27% since its introduction in 2013 contributing £354.8 million in GVA, and for every £1 of tax relief this gives a return on investment to the UK economy of £4.44 [#]

In addition to award winning content, the UK animation industry is highly successful in terms of the ancillary licensed products that it generates, such as children’s DVDs, books, toys and clothing.

Taking into account the ancillary licensed products that it generates, such as children’s DVDs, books, toys and clothing and the licensed merchandise sales market for the UK animation sector and other spillover calculations and impacts, the overall value of the animation sector is calculated at £911.9 million.

# Screen Business: A report Commissioned by the BFI from Olsberg.SPI with Nordicity. October 2018.

The UK’s Animation Sector: In Profile

Offering expertise in a wide range of specialisms, the UK animation industry is original, eclectic and celebrated for storytelling, character development, design and ironic sense of humour and ability to deliver mass global appeal.

The animation industry in the UK produces animated content for television, feature films, commercials, websites, games and virtual & mixed and augmented reality.

The UK is home to distinct and highly successful centres of animation production excellence throughout the country, including Belfast, Bristol, Cardiff, Dundee& Edinburgh, London and Manchester.

The UK’s TV animation industry has a long track record of creative and commercial success. Iconic programmes such as Wallace & Gromit, Tree Fu Tom, Noddy, Peppa Pig, Thomas and Friends, Shaun the Sheep, and Horrid Henry were devised, developed and animated in the UK, are exported around the world and have become highly lucrative global franchises Peppa Pig has audiences in some 180 countries . Other award winning animated content note includes Denis &Gnasher Unleashed, The Clangers, The Amazing World of Gumball, Revolting Rhymes, Gruffalo, Digby Dragon, Hey Duggee and Stick Man.

Animation in the UK has a strong track record track record in character development and storytelling. It also leverages the UK’s global leadership in the artistic and technical aspects of the visual product.

The UK is globally renowned for its expertise in children’s storytelling and design animation. Award-winning examples include cut-out multimedia animation series Charlie and Lola (Tiger Aspect Productions) and Peppa Pig (Astley Baker Davies), Shaun the Sheep and gaming app Ludus (Cube Interactive/Boom Kids).

The UK has an international reputation and is particularly highly-regarded for its expertise in short film animation, such as Aardman Animations’ Oscar-winning Wallace & Gromit series, Half-hour specials such as Snowman and We are Going on a Bear Hunt and Gruffalo, and stop-motion animation, as showcased in Fantastic Mr Fox and stop motion feature-length animated films showcased in Fantastic Mr Frankenweenie, Raymond Briggs Ethel and Ernest (story of his parents) and Early Man (Aardman Animations) with UK animation skills contributing to box office successes such Paddington, Jungle Book and The Lion King.

The UK is a world leader in producing computer-generated animation for computer and video games and home to some of the world’s leading providers of computer-generated visual effects for TV, commercials and feature films.

The UK leads the world in innovative new ways of telling stories and creating new worlds, as illustrated by the globally successful Moshi Monsters, as well as pioneering new work in virtual reality. The UK is also a big growth market for animation used at events, concerts, theatre productions and theme parks.

The UK is highly successful at making animated series based on best-selling books. Examples include Magic Light Pictures, which has created animated programmes based on The Gruffalo; Lupus Films, producer of the sequel to The Snowman; and Walker Books, which is working with many partners to make successful animated series from their children’s titles. Peter Rabbit and Friends, based on the books by Beatrix Potter, has been sold across the globe.

The UK is home to a number of animation festivals and events. Examples include the annual London International Animation Festival, one of the largest of its kind in the world, which showcases some 250 films selected from more than 2,300 submissions from over 30 countries. In 2015 a new animation festival – MAF – launched in Manchester, while other events include the Encounters Short Film and Animation Festival in Bristol and the Children’s Media Conference in Sheffield.

Digital animation is a key part of the UK Technology Strategy Board’s Creative Industries Strategy, which is channeling huge amounts of funding into developing innovation, platforms and technologies to support the creative sector.

Fatal error: Uncaught Error: Call to undefined function twentynineteen_the_posts_navigation() in /home/forge/www.ukscreenalliance.co.uk/public/wp-content/themes/ukscreen/archive.php:41 Stack trace: #0 /home/forge/www.ukscreenalliance.co.uk/public/wp-includes/template-loader.php(106): include() #1 /home/forge/www.ukscreenalliance.co.uk/public/wp-blog-header.php(19): require_once('/home/forge/www...') #2 /home/forge/www.ukscreenalliance.co.uk/public/index.php(17): require('/home/forge/www...') #3 {main} thrown in /home/forge/www.ukscreenalliance.co.uk/public/wp-content/themes/ukscreen/archive.php on line 41