Site: Animation UK

The case for introducing an animation award category in the BAFTA TV Awards

Animation UK presents the case for introducing an animation award category in the BAFTA TV Awards.

Importance of the UK animation sector

The UK animation industry is an important part of the UK’s screen sectors, with a substantial value of £1.3 billion and employing over 20,000 professionals, including freelancers. This sector is not only a vibrant hub of creativity but also a significant economic driver. British animation, known for its distinctive quality, humour, and innovation, has given rise to iconic characters and stories that are integral to the UK’s cultural heritage and enjoy widespread international recognition. The sector’s robust growth, fuelled by increasing global demand for high-quality content, underscores its economic and cultural significance.

Significance of animation as a TV genre

Animation stands out as a versatile and unique genre within television, capable of conveying complex narratives and emotions in ways that live-action media often cannot. Its flexibility allows for innovative storytelling techniques and artistic expressions that captivate a broad audience spectrum, from children to adults. This universality makes animation a crucial component of the television landscape, demonstrating its broad appeal and significant impact on viewers.

Inclusivity and representation

An animation award category within the BAFTA TV Awards would recognise the genre’s excellence and celebrate its inclusivity. Animation reaches all demographics, offering a diverse range of content from children’s entertainment to sophisticated dramas and documentaries for adult audiences. Acknowledging this diversity would highlight BAFTA’s commitment to championing a genre that represents various viewpoints and experiences, encompassing a diverse workforce of writers, directors, artists, and producers.

Animation in TV drama and documentary storytelling

Animation extends beyond children’s programming, increasingly featuring in both dramatic and documentary television storytelling. Animated TV dramas explore themes of fantasy, science fiction, and intricate human emotions in visually compelling ways. Animated documentaries present factual content innovatively, making historical events, scientific concepts, and personal stories more accessible and engaging. This versatility enhances storytelling potential and broadens the medium’s scope, enriching the television landscape.

International recognition of TV animation

Globally, the significance of TV animation is acknowledged through dedicated award categories in prestigious ceremonies. The Emmy Awards, for instance, include categories such as Outstanding Animated Program and Outstanding Short Form Animated Program specifically for television. The Annie Awards also honour achievements in TV animation, underscoring the genre’s importance. By including an animation category, the BAFTA TV Awards would align with both the existing Film Awards and with international standards, reinforcing the UK’s commitment to recognising and nurturing talent and celebrating out content in this vital sector.

Conclusion

Introducing an animation award category in the BAFTA TV Awards would honour the economic and cultural importance of the UK animation industry. It would celebrate the genre’s unique contributions to storytelling across all demographics, reinforcing BAFTA’s dedication to recognising excellence in all forms of creative television expression. Such a move would not only honour outstanding work but also inspire future generations of animators and storytellers to push the boundaries of TV animation.

Renewing EU partnerships and co-production funding

As outlined in the Animation UK Manifesto, the UK animation sector was once a clear beneficiary of European investment through Creative Europe/Media Funds, with networks to support co-production partnerships and opportunities to pitch projects to global commissioners and buyers.

These opportunities no longer exist, and the animation sector now relies on alternative sources, like the much welcomed, but tiny UK Global Screen Fund. However, these funds neither match previous levels, nor promote commercially viable content, resulting in our stake in co-productions being minority rights holders.

Public funds are currently geared toward subsidy, not commercial success and levels of funding need to be more adequate for securing co-production majority rights. Animation UK’s proposed strategy is to review the focus for UK film funding and increase the UK Global Screen Funds, which should be undertaken to reflect the opportunities of IP development leverage public investment to enable UK production companies to secure majority co-production

rights and convert this investment into long-term revenue and business growth. By investing in and preserving IP, the ripple effect will extend beyond pure sectoral growth; it will rejuvenate production companies across the UK, spur job creation nationwide, and bolster the broader film and TV sectors. We strongly advocate for re-affiliation with Creative

Europe/Media as an associate member to access partnership funding and in parallel increase UK Global Screen Funding overall to leverage co-production opportunities.

The return on investment would be that between 2014 and 2019, the UK received £100m investment in film and animation from the EU programmes. We should invest to unlock funds, networks, and commissions.

Leveraging private investment in content and business growth

As outlined in the Animation UK Manifesto, Animation is distinctive among the screen sectors for the time it takes to develop, produce, and recoup a project. However, another distinguishing feature is the potential longtail of investment returns as animation productions continue to generate returns over a long period because a high proportion of returns are generated from additional revenue streams following the project’s release – for example, from merchandising and licensing. Animated content also travels well and is highly exportable. However, current private investment schemes should be amended to unlock more investment in animation studios and their output.

Animation UK’s proposed strategy is to further incentivise private sector tax investment in growth and extend the

required holding periods for EIS and SEIS investments. This would encourage investors to stay invested for a more extended period, potentially increasing the chances of successful IP development. In addition, provide targeted guidance and support to companies engaged in IP development and use fiscal incentives to better support the

animation sector, including developing standard methods for valuing IP and exploring links to Patent Box eligibility.

The return on investment would be a 100% increase in private investment.

Raising Investment in UK Originated Animation Content

Animation UK and the importance of serving young audiences.

25% of the audience and 100% of the future.

The last decade has witnessed a dramatic transformation in the viewing habits of children. Alongside the 80% decrease in content investment for this demographic, evidence suggests a clear market shortcomings for UK originated PSB content. Simultaneously, various studies underline the significance of such high-quality content that not only entertains but also reflects societal values, resonates with UK children, and crucially, bolsters educational outcomes.

The call for immediate interventions is unanimous. There’s a shared belief in the need to guarantee children’s access to premium content. While other proposals highlight the essential role of Public Service Broadcasting (PSB) and its educational importance, Animation UK’s approach is s centred on financial support. The industry doesn’t seek charity or hand-outs. Equipped with talent, innovation, and the ability to draw business, what it critically lacks is domestic content investment. This decline in PSBs’ commitment to children’s content is a manifestation of the market’s inadequacy.

However, the prestige of UK Kids Content, encompassing both animation and live-action, remains high. Its history is one of consistent creative successes with huge potential for export. By strategically channelling funds and maintaining Intellectual Property (IP) rights within the UK, we can cater to our audience and simultaneously reclaim our position as global frontrunners. By investing and preserving UK IP, the ripple effect will extend beyond sectoral growth; it will rejuvenate production companies across the UK spur job creation nationwide, and bolster the broader film and TV sectors.

Animation UK had signalled the importance of the Contestable Model and the success of the pilot Young Audience Content Fund in this context, joined the growing group of organisations to expressed disappointment and concern about the premature decision to stop the YACF funding which had been responsive and inclusive; the nature & range of content also meets regional, and diversity criteria, intrinsic to PSB remits. However this approach could be changed and built upon.

Our proposal outlines the foundations for a hybrid financial model, inspired by successful international templates. Designed to synergise public and private entities and partnerships, its aim is to foster an ecosystem conducive to a long term strategy for children’s content in the UK. Headline criteria are proposed below, to be elaborated through an Industry driven plan:

- Importance of the issue: Children make up 25% of the audience today but are 100% of the future. Their viewing habits indicate an indifference to platforms, necessitating a rethink that puts the availability of content not the platform as the focus.

- Sectoral Implications: The UK’s film and TV industry is celebrated as a commercial success story. The Children’s content sector is a vital part of the overall film and TV sector, known for its storytelling and innovation.

- Investment and Support: The focus should be on content creation, sustained growth, and a private-public partnership with a long-term vision.

- Funding Model: Drawing inspiration from international models, funding should be obtained through a mix quotas, levies, and public financing. A strategic Children’s Funding model should be scalable, sustainable, accountable, and recuperable.

- Inclusive Funding System: A funding system, resembling the French CNC model, should be established for the Kids Content Fund. Multiple models like CNC, CMC in Canada, Australian Children’s Television Foundation (ACTF), etc., can be considered. Contributions would be made by PSBs and commercial broadcasters.

- Monitoring: OFCOM should oversee quotas for each PSB based on their turnover. These quotas should define both investment and broadcast hours for UK-originated content.

- Building the Children’s Content Investment Fund: In addition to contributions from broadcasters (PSB and commercial) and streamers, the fund will receive direct contributions from multiple governmental departments including the DFE and Nations.

- Additional Financial Support: The fund should be bolstered by increased tax relief for kids’ content as well as direct government contributions. A proposed tax relief of 37% for all accessing the fund to develop UK culturally relevant content, linked to UK IP development and/or are produced in the regions & Nations of the UK.

- Access to the fund: UK Independent producers addition to Broadcasters should be able to access the fund, but the latter should invest additional funds into production as part of quota obligations and by commercial broadcasters only if they contribute to the fund

- Fund Usage: The fund should predominantly be utilised for content production but also development. Content can be immersive, interactive, linear, across genres and forms, live action and animation.

- Commercial Emphasis: The fund should incorporate and reward commercial viability, and recuperable proportionate to profit

- Content Identification: Content financed by the UK Kids Content Fund should be available on any free to access platform.

Animation UK Manifesto: A Blueprint for Sector Growth

Animation UK Manifesto: A Blueprint for Sector Growth

We have developed a strategic roadmap to leverage our creative strengths, ensuring local and UK-wide growth. Our recommendations align with the sector’s growth and job creation potential, setting the stage for the UK to lead globally in animation. These proposals are underpinned by creating high-quality content for arguably the most important UK audience, our young people, content that directly supports our cultural soft power and educational attainment. These proposals will not only position the animation sector as a world leader, but as an essential part of the wider TV and film sectors. Animation UK is advocating for these changes with the Government and Shadow team, both during and after the election of 2024.

UK Government extends the Animation Tax Relief increase of 39% to include animated films as well as TV programmes

During his Budget Speech on 15 March, the Chancellor of the Exchequer, Jeremy Hunt announced that the animation and children’s TV sector would benefit from a 39% Audio-Visual Expenditure Credit (AVEC), praising the film and TV industry as a major contributor to growth in the UK.

On 18 July, HM Revenue and Customs published the draft legislation for the Audio-Visual Tax Relief reform, which announced that not only would animation and children’s TV receive a credit rate of 39% (29.25% net after tax), but to ensure fairness, the higher rate of credit will be extended to include animated theatrical release films. This will take effect from 1 January 2024. Hitherto, animated features were eligible to claim the existing Film Tax Relief at a rate of 25%, so including animated features in the Animation AVEC represents a significant 4.25% net uplift after tax.

Responsible for building the case for the original animation tax credit, Animation UK has campaigned tirelessly for tax incentives to increase, in the light of competitive international offers. It argued the case, supported by compelling evidence from its members, for the animation uplift to include animated theatrical release films.

Having presented the business and financial case on behalf of our members, Animation UK is delighted with the decision taken by HMT/HMRC and DCMS to apply the AVEC animation uplift to theatrical features, a strategic move that firmly places the UK animation industry on the global stage during this crucial period.

The resulting enhancement across the industry is set to supercharge its overall growth. Not only do these animations attract significant budgets (in the ballpark of £15m-£100m), but they also herald advanced technological breakthroughs, while offering long-term, sustainable employment opportunities for a workforce of up to 250 people throughout the entirety of a project’s lifespan. Overall, our animated content plays an immeasurable role in our nation’s soft power, driving exports, and promoting the uniqueness of UK creativity worldwide. Regarded as the zenith of our animated output, this inclusion of animated features is not just beneficial, but fundamentally essential to the vitality of the industry. The animation sector as a whole stands to reap immense benefits from this progressive step.

Kate O’Connor, Executive Chair of Animation UK

As an independent producer of high-quality animated features for global audiences Locksmith Animation is delighted that the AVEC animation uplift is being applied to theatrical features. This incentivises UK-based production at the very highest level of animation; leading to ongoing investment in developing the talent and technology to produce big budget world-class animated films that promote UK creativity across the world.

Britt Gardiner, Chief Operating Officer of Locksmith Animation and Chair of the Animation UK Features Working Group

I was delighted to hear the news on 18 July that animated films released theatrically will also be eligible for the AVEC animation tax uplift.

Aardman over the last 20+ years has released eight films theatrically, and will be releasing our ninth film ‘Chicken Run: Dawn of the Nugget’ on Netflix in December of this year.

The film industry is continuing to go through much change on how films are distributed and consumed, and this is an important step to ensure a level playing field for raising finance for all films, no matter how they are distributed, giving more flexibility in distribution models and of course, attracting investment in the UK animation industry.

With a film typically taking at least five years to develop, finance and produce, I congratulate HMT, HMRC and DCMS in providing a timely response to Animation UK’s paper on the subject and providing some real and meaningful certainty to allow the UK animated film industry to continue to thrive.

Sean Clarke, Managing Director of Aardman

We want the UK to be the best place to start and grow a business and while we have the lowest corporation tax rate in the G7, we are not complacent.

The changes we are making are about backing business to innovate and grow the UK economy, creating good jobs across the country.

Victoria Atkins, Financial Secretary to HM Treasury

Driving Exports

Animation UK works with the DIT, BFI and regional screen agencies to give the sector an effective presence at overseas programme markets like Kidscreen and Annecy. We also participate in the Creative Industries Trade and Investment Board.

With its long and successful history and an extremely positive global reputation, the animation sector operates in distinct markets and has untapped potential overall to achieve higher export value. This requires targeted support for co-production deals, straight sales of finished formats with licensing agreements, service promotion and harnessing the opportunities for animation companies to exploit and benefit from the longer tail including merchandising, brand and character development.

Animation UK represents the sector on the newly established Creative Industries Trade and Export Board, which will now set the strategy and allocate funding to support export activity. We make the case for distinct and separate funding for animation companies to attend the right markets.

Animation UK, supported by the Department for International Trade, has in the past supported the CMC at Kidscreen by attracting additional funding for the delegation to Miami, and led the UK’s animation presence at Annecy 2017, 2018, 2019 and 2020, with plans for continuing a significant presence at the 2021 virtual Annecy festival.

Animation Export Toolkit

On Tuesday 20th April, Animation UK sponsored by the Department of international trade held a virtual session for an afternoon to find out about how to develop an export strategy, advice on marketing and pitching, and information on global buyers and markets, as well as new ways to monetise IP.

A PDF of the Animation Export Strategy Toolkit presentation is now available to view & download, providing key information and pointers, steps and stages to think about when developing your own strategy. This will be an evolving resource, which Animation UK will update when new information and research becomes apparent. View & download the presentation here.

(This presentation works best as an accompanying document to the recordings of our Animation Export Strategy Workshop, which can be viewed below.)

We would like to thank our incredible presenter, Creative Facilitator Justine Bannister, who had the extensive task of collating research for and creating an in-depth Toolkit on exporting animation, and guest speakers Andrew Baker, CEO, Cantilever Media, Natalie Llewellyn, Managing Director, Jellyfish Originals, and Anthony Humphreys, Specialist, Department for International Trade, who all provided much-appreciated knowledge and insights on the day.

A recording of the session is now live on our partner company UK Screen Alliance’s Youtube account, divided into 5 parts according to the different module overviews explored in the event:

- Animation Export Strategy Workshop – Module 1 – Introduction & Groundwork

- Animation Export Strategy Workshop – Module 2 – The Animation Landscape & Business of Animation

- Animation Export Strategy Workshop – Module 3 – Your Export Strategy & Global Players

- Animation Export Strategy Workshop – Module 4 – Routes to Market, Financing & Sales Events

- Animation Export Strategy Workshop – Module 5 – Pitching Preparation

Visit the link here to view a playlist of these recordings, of view below:

Maintaining competitive tax incentives for animation

UK Animation tax credits are very successful in attracting international work, but we must maintain our global competitiveness.

The Animation tax credit is very successful in attracting productions to the UK, but as other territories also seek a piece of that action, we must ensure that our animation sector remains globally competitive.

The new Audio-Visual Expenditure Credits (AVEC) came into effect on 1st January 2024 and gives a taxable credit rate of 39% for animated films, animated TV programmes and children’s TV programmes, which equates to a refund of up to 29.25% on eligible UK spend. It can be accessed during production or retrospectively, it is available for budgets of any size and for both short and feature animation films and animation TV programmes of any duration.

Films, high-end TV programmes and videogames can claim a taxable credit rate of 34% (effective refund of up to 25.5% of eligible UK spend). An additional uplift to 53% under AVEC (equating to a tax relief of approximately 40%) will be available for films with a max budget of £15 million.

While these announcements are warmly welcomed, Animation UK seeks to enhance our competitive edge through increased tax incentives, and will continue to undertake a review of tax incentives in specific markets, as well as gather information and a read-out from our members on how the sector is shaping up, including loss of business and trends generally.

Commissions are secured on the combination of creative content, skills and talent, but also, critically on value for money and the tax incentives. Other territories increasingly recognise the growth potential held by the animation sector and are providing competitive terms to attract international contracts and secure rights. We welcome the recently announced increase to the independent film tax relief rate and have presented a more detailed proposal presenting an evidenced case for uplifting the animation tax reliefs overall across film and TV, which will boost growth and jobs. Independent evidence detailed in our fuller proposal underscores that this is not a hand-out, nor a cost to Treasury and will support regional growth.

We are currently campaigning for tax relief rates to be increased to 37%, aiming to double TV animation production spend within four years, creating 6,000 jobs and adding £500 million to the GVA. Every £1 investment will generate a return of £4.44.

Animation UK is in ongoing consultations with HMRC, DCMS and the BFI to ensure any recommendations to support inward investment and wider policies can be heard by decision-makers, while reflecting on the impact of recent changes to the status of UK content with regard to international competitors.

Closing the animation skills gap

Animation UK want to develop a real partnership between the industry and education providers to ensure that our young skilled talent directly feeds into and supports the Animation sector in the UK.

Animation UK has published an Animation UK Manifesto, which outlines five proposals that offer a strategic and linked approach to fuel the growth of the UK animation industry. By focusing on competitive tax incentives, reversing PSB investment cuts, leveraging commercial opportunities and investment in IP linked to downstream revenue and investing in education and skills, we aim to not only safeguard the future of the UK animation sector, but also, to position it as a global leader in innovation and creativity. In each case, the recommendations minimise any direct contribution from the Government, and we have indicated a return on investment or an investment return on the intervention. Together, they will create a climate for growth.

The current state of creative education is concerning, with it being increasingly devalued and underfunded in the public education system. Much like other creative sectors, the animation industry faces significant skills gaps and shortages at various levels. Notably, animation skills are crucial and transferable across digital production and across the broader creative economy.

To address the skills crisis, we propose a new partnership investment plan. This plan aims to bridge skills gaps and shortages at all levels, ultimately positioning the UK as a global leader in digital production. Strategic investment in the future facing skills and talent is imperative. Investments should involve collaboration between national and local governments and industry partners. We suggest a new approach to link employer skills contributions to tax relief and production-based training to boost employer investment in this plan.

In December 2023, Olsberg SPI was commissioned by the BFI to publish the “Skills Scoping Study for the UK’s

Digital Content Production Sectors“. The report identified key skills gaps and shortages that translate into real opportunities for job creation UK-wide across the UK’s growing digital content production sectors. Read more details in the press release here.

This report underscores the skills gaps and shortages, the cross-sector mobility, and the competition from overseas for our skilled workforce and talent. Developing strategies to nurture and retain our skilled workforce is imperative, particularly as animation not only generates widespread employment across the UK but also bolsters high-quality jobs. With a workforce of over 16,000 based across the UK in hubs in every region and nation, animation craft, technical and creative skills are central to all digital production.

The consequences of inaction are significant. The digital production sector overall, acting as the R&D hub for the screen industries and the broader virtual and immersive content, plays a key role. By positioning the UK as a global epicentre for cutting-edge computer-generated content and technologies, we can also extend our expertise to diverse fields such as industrial design, medicine, retail, education, and the evolution of the digital landscape. This report is a catalyst for developing strategies that support growth and will be thoroughly reviewed by the Industry Skills Task Force in the ensuing months.

Kate O’Connor, Executive Chair of Animation UK

In early 2024, Animation UK and UK Screen Alliance launched their new Education membership. This branch was formed with the aim of improving the connection between educators and industry to address ongoing skills issues.

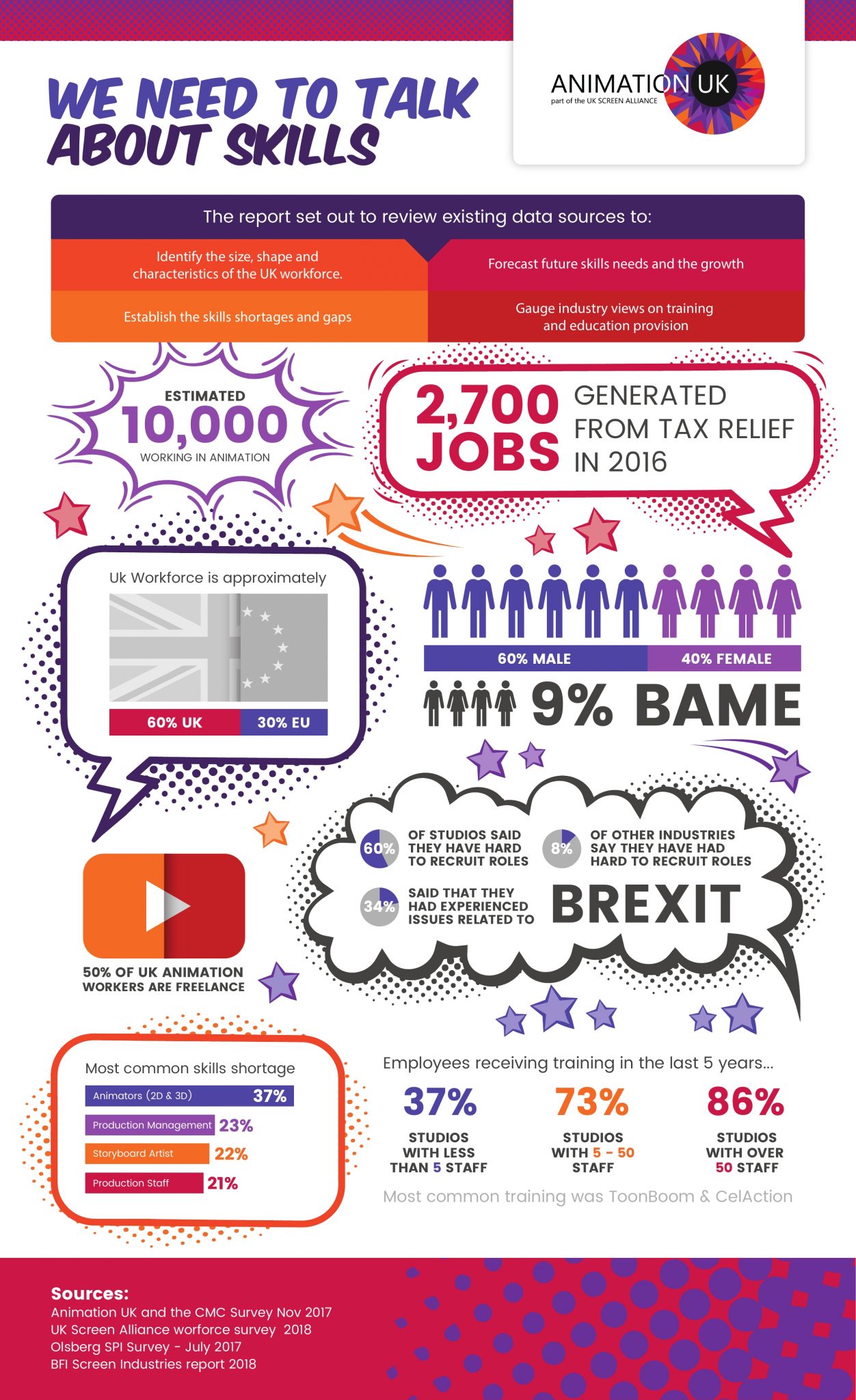

Previous work

In 2018, Animation UK carried out vital research highlighting skills gaps, and workforce shortages within UK Animation, and published the report “We need to talk about skills”. Funded by the Animation Skills levy, this report collected all current data on skills and employment in the sector. It drew on national data sources, up-to date employer surveys conducted by the UK Screen Alliance and a wide-reaching survey carried out by Animation UK. It collected known data on the workforce, highlighted range of skills gaps and shortages, and illustrated that Animation is continually under-served by national data sources.

Animation UK worked with the newly established Animation Skills Council set up by ScreenSkills and chaired by Tom Box, the NextGen Skills Academy, Higher Education and a range of other partners to find solutions.

It is vital that we develop a real partnership between the industry and education providers to ensure that our young skilled talent directly feeds into and supports the Animation sector in the UK. We have a significant challenge ahead, with a need for careers information and mentors through to developing higher level creative skills and talent and Animation UK will focus its effort on supporting the essential partnership and dialogue between the industry and education.

Kate O’Connor, Executive Chair of Animation UK

Mapping the UK Animation sector

The Animation sector is currently under-served in terms of national data sources.

In addition to our ongoing advocacy, Animation UK works hard to gather the data and ensure we can provide the most accurate estimates of size, outputs and impacts.

The Animation sector, in terms of national data sources, is not captured separately by SIC or SOC codes and is often therefore embedded in broader sector classifications. Referred to sometimes as animation genre, a skill/role the sector is subsumed with broader areas such as film, TV or “children’s” content. However, the Animation sector is an economically distinct group of studios, production companies, distribution companies, producing content aimed at different demographics and distributed as cinematic releases, TV formats and shorts used in advertising and corporate productions.

Animation UK successfully informed the BFI Value of the Screen Sectors report in 2018, although the focus was on the productions and value that fell into the scope of the tax relief.

Animation UK has begun work with The BFI’s Research and Statistics unit (funded by the National Lottery) to commission a new piece of research to ‘map’ the size, value and importance of the UK’s animation sector. The mapping aims to fill an evidence gap for investors and policy makers identified by Animation UK. We will be working with a leading economics consultancy, and artificial Intelligence specialists in reading the web and mapping sectors, to identify the business critical issues facing the sector.

More updates to follow.

Fatal error: Uncaught Error: Call to undefined function twentynineteen_the_posts_navigation() in /home/forge/www.ukscreenalliance.co.uk/public/wp-content/themes/ukscreen/archive.php:41 Stack trace: #0 /home/forge/www.ukscreenalliance.co.uk/public/wp-includes/template-loader.php(106): include() #1 /home/forge/www.ukscreenalliance.co.uk/public/wp-blog-header.php(19): require_once('/home/forge/www...') #2 /home/forge/www.ukscreenalliance.co.uk/public/index.php(17): require('/home/forge/www...') #3 {main} thrown in /home/forge/www.ukscreenalliance.co.uk/public/wp-content/themes/ukscreen/archive.php on line 41